comprastrend.online

Market

Mba Finance Vs Mba Marketing

Gaining cross-functional leadership skills is one of the hallmarks of an MBA degree, while the M.S. in Marketing focuses on deep, practical marketing skills. “. The degree will equip students with broad skills and knowledge in business, accounting, marketing, operations, management, and leadership. Both programs are similar, since finance MBA programs offer courses in marketing, and marketing MBA programs offer courses in finance. An MBA. Which is better for You – MBA Finance vs MBA Marketing? Check informative article here - comprastrend.online #mba #pgdm #marketing. While MBA graduates find career opportunities in various functions, including marketing, consulting, and operations, most Masters in finance graduates jump into. Along with several economic courses, MBA programs also include courses unrelated to finance, like leadership, marketing and entrepreneurship. An MF curriculum. MBA in Finance and MBA in Marketing include all core business subjects, but their curriculum and future job options are different. An MBA in Finance imparts knowledge related to accounting and finance. Conversely, an MBA in Marketing explores selling a product or service to a wide range of. Marketing thrives on creativity, various jobs, and significant campaigns, whereas finance offers large pay and complex financial administration. Both routes. Gaining cross-functional leadership skills is one of the hallmarks of an MBA degree, while the M.S. in Marketing focuses on deep, practical marketing skills. “. The degree will equip students with broad skills and knowledge in business, accounting, marketing, operations, management, and leadership. Both programs are similar, since finance MBA programs offer courses in marketing, and marketing MBA programs offer courses in finance. An MBA. Which is better for You – MBA Finance vs MBA Marketing? Check informative article here - comprastrend.online #mba #pgdm #marketing. While MBA graduates find career opportunities in various functions, including marketing, consulting, and operations, most Masters in finance graduates jump into. Along with several economic courses, MBA programs also include courses unrelated to finance, like leadership, marketing and entrepreneurship. An MF curriculum. MBA in Finance and MBA in Marketing include all core business subjects, but their curriculum and future job options are different. An MBA in Finance imparts knowledge related to accounting and finance. Conversely, an MBA in Marketing explores selling a product or service to a wide range of. Marketing thrives on creativity, various jobs, and significant campaigns, whereas finance offers large pay and complex financial administration. Both routes.

MBA Marketing is a postgraduate management study on marketing that offers a brief study of the market and customer management. The curriculum of an MBA in Finance focuses on financial concepts and analytical skills, while an MBA in Marketing focuses on marketing strategies and consumer. MBA vs. Master's in Management. With so many graduate business degree options, from the well-known Master of Business Administration (MBA) to specialized. An MBA in Marketing typically offers a broader curriculum that covers not only marketing but also other business disciplines such as finance. When it comes to career prospects, MBA Marketing graduates have an altogether distinct sector to explore when compared with MBA finance graduates. Often. In general, an MS focuses on more in-depth expertise about the marketing discipline and both students or professionals can pursue this degree to obtain much. MBA programs cover a broader subject area than master's degrees in marketing, which may equip students with skills that are transferable to other parts of the. Marketing is a better choice because the ceiling is higher and the space is wider. You have more freedom for creativity when you choose marketing as a career. An MBA in finance is a Master of Business Administration degree program that combines instruction and training in general business theories and practices with. Traditional master's in marketing programs, compared to MBA programs, involve one- or two-year curricula that focus on marketing and general management. I find Marketing more interesting and I find finance somehow boring but yea Finance has better salaries, has a more rigorous career path and. If you have an interest in playing with numbers and analyzing figures, you should opt for Finance. If you have an aptitude for convincing people, communicating. MBA Finance vs MBA Marketing – Scope The reality is that both degrees have tremendous scope. A strong marketing department can change the fortunes of an. Graduates of both MBA and MF programs can expect a quality education that will further their careers in business and/or finance. · An MBA focuses on business. Mostly MBA in finance is more preferred by most students globally. However, MBA in marketing has its own merits. You can always get a marketing job with a finance degree & marketing certifications. But it's harder to get a finance job with a marketing. Ultimately, the marketing function is responsible for helping the broader organization reach its financial goals. Take Your Next Step with an MBA in Marketing. A marketing master's degree is more specialized. It teaches you skills that are specific to marketing, including social media, SEO, and market research. Before making a choice between MBA Finance and MBA Marketing, you need to consider what your interests are and which one of the two options is a better match. An MBA program covers all things business, while a Master of Science in Finance program focuses on honing knowledge of the finance sector. You can get a better.

The Best Paying Online Slots

Best Payout Slots FAQ. What slot machines have the best payouts? Some of the highest paying online slots you can find are Beat the Bank and Ugga Bugga, both. Thunderkick's video slot, boasting 25 active paylines and an impressive % RTP, stands as one of the best-paying slots. The game offers extra thrills with. Wild Casino and Bovada stand out as the best paying online casinos in the USA. They even have their own versions of the game that add a different style and can. Open the Mac App Store to buy and download apps. Casino Slots Real Money 17+. Real Money Casino Online. We've put together an easy-to-follow guide for all those interested in learning about how to safely and successfully play online slots. Dubbed the #1 online casino for lady gamers in the UK since , Pink Casino caters to all types of players, including, of course, those looking for high. NetEnt, for instance, is all about razor-sharp animations and deep bonus rounds. Big Time Gaming is your go-to for slots with the chance of massive payouts. DraftKings is the best online slots casino in our ratings right now. In some states, it offers more than 1, slots, including exclusives such as 2 Tribes. Every game has a percentage of what it will payout to players over its lifetime and determines the house edge. Most games vary anywhere between 92% and 99%. Best Payout Slots FAQ. What slot machines have the best payouts? Some of the highest paying online slots you can find are Beat the Bank and Ugga Bugga, both. Thunderkick's video slot, boasting 25 active paylines and an impressive % RTP, stands as one of the best-paying slots. The game offers extra thrills with. Wild Casino and Bovada stand out as the best paying online casinos in the USA. They even have their own versions of the game that add a different style and can. Open the Mac App Store to buy and download apps. Casino Slots Real Money 17+. Real Money Casino Online. We've put together an easy-to-follow guide for all those interested in learning about how to safely and successfully play online slots. Dubbed the #1 online casino for lady gamers in the UK since , Pink Casino caters to all types of players, including, of course, those looking for high. NetEnt, for instance, is all about razor-sharp animations and deep bonus rounds. Big Time Gaming is your go-to for slots with the chance of massive payouts. DraftKings is the best online slots casino in our ratings right now. In some states, it offers more than 1, slots, including exclusives such as 2 Tribes. Every game has a percentage of what it will payout to players over its lifetime and determines the house edge. Most games vary anywhere between 92% and 99%.

BetMGM's online casino is available in Michigan, New Jersey, Pennsylvania and West Virginia. You can choose from hundreds of different slot games. The Highest RTP Slots · Goblin's Cave: This three-reel game from Playtech has a lot in common with AWP games or fruit machines, including a two-round format. Best Online Slots for Real Money WildCasino (Dragon Inferno) - % RTP SuperSlots (Wilderness Wins) - 97% RTP PayDay Casino (Thunderbird) - 97%. The truth is, there is no specific best time to play slots, as they are games that are completely random in nature. Best payout online casino by category · 1. ✓ Hello Millions: Best high payout casino overall · 2. ⚖️ Real Prize: Casino with the best payout rate · 3. I am not able to provide you with a list of the top 5 best online real money slots with the highest payouts as the payout percentage of slot machines can vary. Top 10 Best Payout Slots in · 1. Tombstone RIP | ,x · 2. Emerald King Rainbow Road | ,x · 3. Max Megaways | ,x · 4. Apollo Pays – ,x · 5. Zula casino, Pulsz, Modo, Hello millions, Mcluck, Luckyland, Chumba, High5casino, FortuneCoins, Most take under a week to cash out once verified. Looking for the best payout slots in New Jersey? You've come to the right place. Our team of experts has put together this comprehensive guide to see what. Top 5 real money slot games · 1. Sweet Bonanza (Pragmatic Play) · 2. Big Bamboo (Push Gaming) · 3. Cursed Seas (Hacksaw Gaming) · 4. Ankh of Anubis (Play'n GO) · 5. The Top 5 Highest Paying Online Slot Machines · Mega Moolah, Microgaming: RTP of 88% · Mega Fortune, NetEnt: RTP of % · Immortal Romance, Microgaming: RTP. Top 10 Best Payout Online Slots in · 1. Dead or Alive 2 – ,x · 2. Da Vinci Diamonds – 5,x · 3. Cash Volt – 2,x · 4. Monopoly Megaways – 14,x · 5. I'd say the best online casino game that actually pays out is roulette. You can use different systems to lower the house edge and improve. DuckyLuck's combination of a great game selection and generous bonuses makes it our top overall pick for online slots. With over titles, and new additions. The title of best payout slot of all time belongs to Tombstone RIP by NoLimit City. With a maximum potential payout of ,x, the team behind this slot have. We have listed the top online slots for real money to assist you in finding the best online slots. All of these slots are of high quality and fulfill our high. BetMGM Casino Michigan is the far-and-away leader in the state with more than double the online revenue of its nearest competitors, FanDuel MI and DraftKings MI. Enjoy the Ultimate Cash Storm Casino Slot Game! Play the real thrill of casino slot games anytime, anywhere! Spin to Win, Win Thrills Download the best. Lucky Creek is the top online casino in Texas for high-RTP online slots. Not only will you find an amazing selection of slot games to play – but you can also. Discover the best online slots for real money and play exciting slot titles that offer big bonuses, high payouts, and thrilling progressive jackpots.

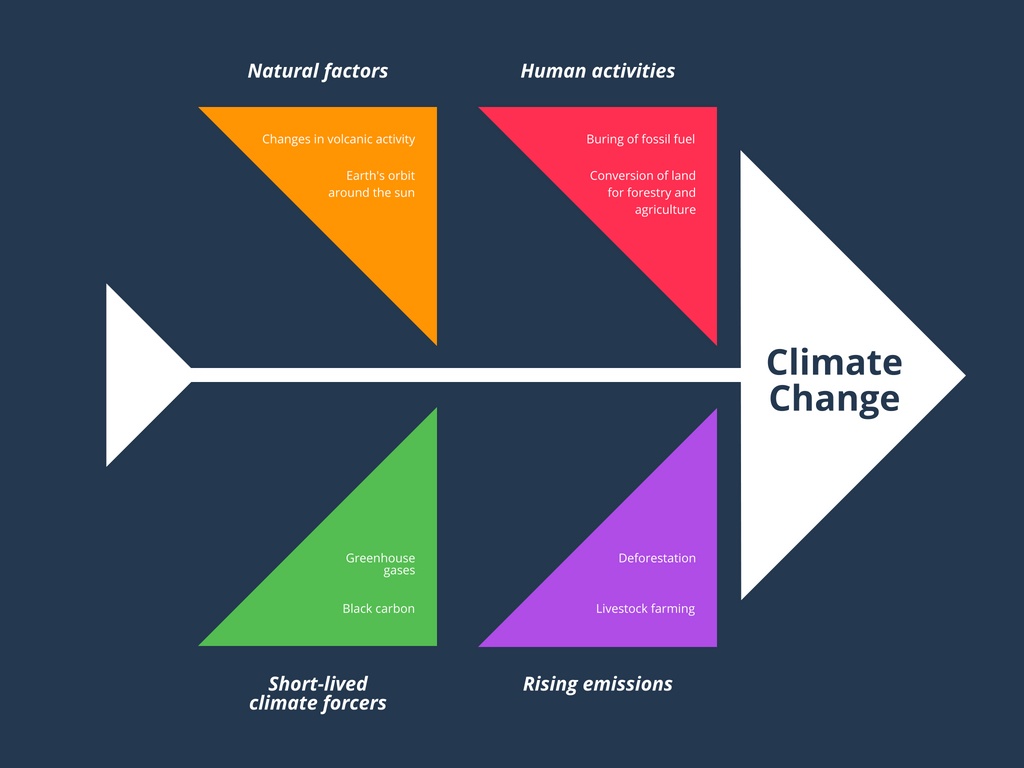

Environmental Causes

factors in the environment affect people who have moderate to severe asthma. While this finding adds to knowledge about environmental risk factors for. environmental impact associated with it. We're committed to collaboration factors, well-to-wheels factors, and powertrain mismatch factors. We then. Environmental pollutants can cause health problems like respiratory diseases, heart disease, and some types of cancer. People with low incomes are more. There are many causes of autism. Research suggests that autism spectrum disorder (ASD) develops from a combination of: Genetic influences and; Environmental. Systemic racism, such as misguided regulatory policy, causes environmental injustice. Our law firm fights environmental injustice. Currently, it's believed a combination of genetic changes and environmental factors may be responsible for the condition. Genetics. A number of genetic factors. Environmental pollutants can cause health problems like respiratory diseases, heart disease, and some types of cancer. People with low incomes are more. An increase of 2°C compared to the temperature in pre-industrial times is associated with serious negative impacts on to the natural environment and human. Occasionally the cause of an outbreak is unknown, even after thorough investigation. Communicable disease outbreaks. Environmental factors influencing the. factors in the environment affect people who have moderate to severe asthma. While this finding adds to knowledge about environmental risk factors for. environmental impact associated with it. We're committed to collaboration factors, well-to-wheels factors, and powertrain mismatch factors. We then. Environmental pollutants can cause health problems like respiratory diseases, heart disease, and some types of cancer. People with low incomes are more. There are many causes of autism. Research suggests that autism spectrum disorder (ASD) develops from a combination of: Genetic influences and; Environmental. Systemic racism, such as misguided regulatory policy, causes environmental injustice. Our law firm fights environmental injustice. Currently, it's believed a combination of genetic changes and environmental factors may be responsible for the condition. Genetics. A number of genetic factors. Environmental pollutants can cause health problems like respiratory diseases, heart disease, and some types of cancer. People with low incomes are more. An increase of 2°C compared to the temperature in pre-industrial times is associated with serious negative impacts on to the natural environment and human. Occasionally the cause of an outbreak is unknown, even after thorough investigation. Communicable disease outbreaks. Environmental factors influencing the.

College of Agriculture, Urban Sustainability & Environmental Sciences · ACADEMIC DEPARTMENTS & PROGRAMS · LAND-GRANT CENTERS. Currently, it's believed a combination of genetic changes and environmental factors may be responsible for the condition. Genetics. A number of genetic factors. Researchers believe lupus results from a complex equation of multiple factors including your genetic makeup, your hormones, and your environment. Environmental Factors in Parkinson's Disease · Pesticides/herbicides: Studies have shown a link between exposure to chemicals in pesticides and herbicides, and. Pollution from agriculture and waste water are a particular issue, resulting in nutrient pollution which causes excessive plant growth and algal blooms, while. They believe that a mix of factors trigger MS. Studies support the idea that a trigger in the environment may cause MS in certain people who have a specific. causes and reduce the effects of climate change and environmental degradation. How Rotary makes help happen. Rotary members are tackling environmental issues. Patagonia Action Works helps you discover events, petitions and skilled volunteering opportunities in your backyard and donate money to local causes. Act Now. A variety of environmental factors can increase the likelihood of anxiety. For example, a person's family composition, their cultural and religious upbringing. We're an environmental organization creating lasting solutions to our biggest environmental issues — climate change, air pollution and more. environmental migration, of which environmental displacement is one cause. As the effects of climate change intensify, the number of environmental migrants. Most experts agree that PD is caused by a combination of genetic and environmental factors (chemicals, toxins, head trauma). The interactions between genetics. The Causes of Climate Change · Increasing Greenhouses Gases Are Warming the Planet · Human Activity Is the Cause of Increased Greenhouse Gas Concentrations. environmental factors that influence human health, including physical, chemical, and biological factors external to a person, and all related behaviors. Causes of Environmental Racism. Causes of environmental racism relate to the availability of affordable land, lack of political power to fight corporations, and. A variety of environmental factors can increase the likelihood of anxiety. For example, a person's family composition, their cultural and religious upbringing. Home Environment. Our causes. Environment. Lions and Leos are working to protect the environment to create healthier communities and a more sustainable world. ENVIRONMENTAL CAUSES OF TREE DAMAGE. Trees are damaged by a variety of weather events including storms, drought and flooding. Chemicals like pesticides and salt. An environmental factor, ecological factor or eco factor is any factor, abiotic or biotic, that influences living organisms. Abiotic factors include ambient. Environmental issues are disruptions in the usual function of ecosystems. Further, these issues can be caused by humans or they can be natural.

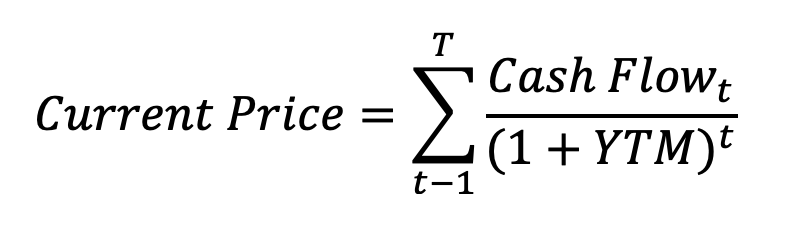

Bond Ytm

Yield to Maturity, or YTM, measures a bond's rate of return when buying it at different times when the price may vary from the original par value. This MATLAB function given NUMBONDS bonds with SIA date parameters and clean prices (excludes accrued interest), returns the bond equivalent yields to. Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it. Yield to maturity requires a complex calculation. It considers the following factors. Coupon rate—The higher a bond or CD's coupon rate, or interest payment. A bond's yield to maturity shows how much an investor's money will earn if the bond is held until it matures. For example, as the table below illustrates. Concept Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM. In the case of a Bond, YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. The YTM formula for a. Yield to maturity is the discount rate at which the sum of all future cash flows from the bond is equal to the price of the bond. YTM is an annualized rate that assumes an investor holds a bond to maturity if it is purchased at its current market price. Yield to Maturity, or YTM, measures a bond's rate of return when buying it at different times when the price may vary from the original par value. This MATLAB function given NUMBONDS bonds with SIA date parameters and clean prices (excludes accrued interest), returns the bond equivalent yields to. Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it. Yield to maturity requires a complex calculation. It considers the following factors. Coupon rate—The higher a bond or CD's coupon rate, or interest payment. A bond's yield to maturity shows how much an investor's money will earn if the bond is held until it matures. For example, as the table below illustrates. Concept Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM. In the case of a Bond, YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. The YTM formula for a. Yield to maturity is the discount rate at which the sum of all future cash flows from the bond is equal to the price of the bond. YTM is an annualized rate that assumes an investor holds a bond to maturity if it is purchased at its current market price.

Calculating YTM requires current price, face value, coupon rate, maturity, and periods until maturity. YTM helps investors compare bonds but doesn't account for. YTM is expressed as an annual return. It tells us the total return that is expected from a bond if the investor holds the bond until maturity. Yield to maturity (YTM); Yield to call (YTC). Nominal yield. The nominal yield is another way to refer to the interest rate (coupon). You. YTM Gives Us the Bond's Price. Given the YTM and a bond's cash flows, we can calculate the bond's price. Say a year bond pays an annual $50 coupon and. The yield to maturity (YTM), book yield or redemption yield of a fixed-interest security is an estimate of the total rate of return anticipated to be earned. The Formula Relating a Bond's Price to its Yield to Maturity, Yield to Call, or Yield to Put · Settlement date = 3/31/ · Maturity = 3/31/ (10 year bond). Mergent Bond Record, January Aa. %. %. %. Mergent Bond Average YTM of Corporate Bonds. Linear (Average YTM of Corporate Bonds). Page. Unlike current yield, the yield to maturity (YTM) (also known as a bond's basis) factors in time as it assumes the investor buys the bond and holds it until. The phrase coupon clipper refers to a wealthy person who lives on bond interest. 3. Page 4. Financial Economics. Yield to Maturity. Example. The yield to maturity (YTM; or redemption yield or book yield) of a bond signifies the annualized return for a bondholder until maturity. Yield to maturity (YTM) is the internal rate of return that equates all future cash flows of a bond to its current price, assuming the bond is held until. Here we are going to take a look at two different ways to calculate bond yield: current yield and yield to maturity (YTM). Yield to maturity (YTM) is defined as the total return that you can expect from your investments in bonds, provided you hold the bond till its maturity. If a bond's yield to maturity is greater than its current yield, the bond is selling at a discount, or a price less than par value. If YTM is less than current. Calculating Yield to Maturity Using the Bond Price. The yield to maturity is the discount rate that returns the bond's market price: YTM = [(Face value/Bond. The price depends on the yield to maturity and the interest rate. If the yield to maturity is, the price of the bond or note will be. greater than the interest. 1) Coupon Rate: This is the fixed annual interest rate that the bond issuer pays its bondholders. · 2) Current Yield: · 3) Yield to Maturity (YTM): · 4) Yield to. Bond Yield-to-Maturity (The capital gain or loss is the difference between par value and the price you actually pay.) The yield-to-maturity is the best. YTM is the interest rate that equates the present value of the coupons of a bond to the bond's current price. Note that the current yield metric only becomes relevant if the market price of the bond deviates from its par value. How to Calculate Yield to Maturity (YTM).

Mortgage Limit Based On Income

For example, the 28/36 rule suggests your housing costs should be limited to 28 percent of your total monthly gross income and 36 percent of your total debt. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Lenders usually require housing expenses plus long-term debt to less than or equal to 33% or 36% of monthly gross income. The current standard USDA loan income limit for member households is $,, up from $, in early The limit for member households is. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. For example, if your gross monthly income is $8,, you should spend no more than $2, on a monthly mortgage payment. The 35% / 45% Rule. The 35% / 45% rule. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment. For example, the 28/36 rule suggests your housing costs should be limited to 28 percent of your total monthly gross income and 36 percent of your total debt. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Lenders usually require housing expenses plus long-term debt to less than or equal to 33% or 36% of monthly gross income. The current standard USDA loan income limit for member households is $,, up from $, in early The limit for member households is. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (eg, principal, interest, taxes and. For example, if your gross monthly income is $8,, you should spend no more than $2, on a monthly mortgage payment. The 35% / 45% Rule. The 35% / 45% rule. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment.

As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. It's still generally around 4 times your income (depends on things like debt and all that). Therefore, the ELI Limit is calculated as 30 percent of median family income for the area and may not be the same as the Section 8 ELI Limit for your. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Use the interactive map to quickly look up loan limit values and income eligibility by area, property address or Federal Information Processing Standards (FIPS). The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not. If you want to play it safe, stick to the 28/36 rule, and make sure your monthly mortgage payment exceeds no more than 28% of your monthly gross income. As you. How much you can deduct depends on the date of the mortgage, the amount of the mortgage, and how you use the mortgage proceeds. If all of your mortgages fit. The maximum mortgage that you can be approved for is determined by a maximum ratio of monthly debt payments to monthly income. This means if you have a lot. The maximum mortgage you may qualify for depends on several factors, including: credit score, combined gross annual income, monthly expenses, the proposed down. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. First, we calculate how much money you can borrow based on your income and monthly debt payments You have to make the mortgage payments each month and live on. This calculator takes the most important factors like your income and expenses and determines the maximum purchase price that you could qualify for. For the purposes of this tool, the default insurance premium figure is based on a premium rate of % of the mortgage amount, which is the rate applicable to a. What is the maximum mortgage loan that you can apply for? That largely depends on your income and current monthly debt payments. This calculator collects. Monthly Income X 36% - Other loan payments = monthly PITI. Maximum principal and interest (PI). This is your maximum monthly principal and interest payment. It. Understanding how much mortgage you can afford · How much a mortgage lender will qualify you to borrow, based on your income, debt and down payment savings · How. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our required income for a. This affordability slider helps you decides how much of your disposable income is allocated to mortgage payments, home expenses and monthly debt payments.

Perkins Early Bird Special

curated specials & coupons from Perkins Restaurant & Bakery tested & verified by our team daily Order Today's Breakfast & Early Bird Specials. Get Offer. 8. Early Bird Jumbo Shrimp. breaded and fried with cocktail sauce. Early Bird Smothered Chicken. grilled chicken with onions, peppers and cheese. Early Bird Liver. Enjoy our deep-fried cod with french fries, cole slaw & dinner roll. Served until a.m. (excludes any other discounts, “To-Go” Bags, & sharing plates). Menu. Site Navigation. Sports · Men's Sports · Baseball · Roster · Schedule · News · Stats USD Early Bird @ University of South Dakota; Vermillion, SD. Journal Special Collections · Books · Publish with ESA Open submenu Entomology - Early Bird Registration Deadline. Sep Register early to. Residents of the Bayou Region can also get free cancer screenings though the Early Bird, a mobile medical clinic that helps bring early detection to the. Menu, Daily Specials, Kid's Menu, Avondale PA, Newark DE, Philadelphia (Grant Plaza) PA, Drexel Hill PA, Work Here. Prevention on the Go is designed to provide education and early detection services in locations where people live, work, worship, shop and play. Early bird or an evening owl - when is your favorite time of day to visit us at Perkins? Around comprastrend.online dad will usually get breakfast and I. curated specials & coupons from Perkins Restaurant & Bakery tested & verified by our team daily Order Today's Breakfast & Early Bird Specials. Get Offer. 8. Early Bird Jumbo Shrimp. breaded and fried with cocktail sauce. Early Bird Smothered Chicken. grilled chicken with onions, peppers and cheese. Early Bird Liver. Enjoy our deep-fried cod with french fries, cole slaw & dinner roll. Served until a.m. (excludes any other discounts, “To-Go” Bags, & sharing plates). Menu. Site Navigation. Sports · Men's Sports · Baseball · Roster · Schedule · News · Stats USD Early Bird @ University of South Dakota; Vermillion, SD. Journal Special Collections · Books · Publish with ESA Open submenu Entomology - Early Bird Registration Deadline. Sep Register early to. Residents of the Bayou Region can also get free cancer screenings though the Early Bird, a mobile medical clinic that helps bring early detection to the. Menu, Daily Specials, Kid's Menu, Avondale PA, Newark DE, Philadelphia (Grant Plaza) PA, Drexel Hill PA, Work Here. Prevention on the Go is designed to provide education and early detection services in locations where people live, work, worship, shop and play. Early bird or an evening owl - when is your favorite time of day to visit us at Perkins? Around comprastrend.online dad will usually get breakfast and I.

Perkins Restaurant & Bakery: Go for the early bird special - See 34 traveler reviews, 3 candid photos, and great deals for East Brunswick, NJ. Early bird promotions at Perkins Restaurant and Bakery. Ends Get Super Stock Freedom of Perkins Restaurant & Bakery special things is proposed to. Close menu. About. I am a public transporter. Specializing in doctor appointments, schools pickups and drop ups. I have 20 years of taxi driving experience. Individuals will want to sign up early. We would like to extend a special thanks. Event Details. Join your neighbors and. These are "hungry bird" specials! Early Break Combos feature deliciously bountiful choices like our new Chicken 'n Waffles and Magnificent Seven, and our new. May book sites are associated with Amazon like BookBub or Early Bird and many more and of course Kindle Book Store. When you sign up for BookBub or any book. Lunch Early Bird Specials Baked Potato Loaded W Whipped. History: Early Bird classics are now here to stay! We will offer our classics menu in addition to specials and limited time offerings. See all reviews. Main Navigation Menu. Sports. Sports. Men's Sports; Basketball · Cross Country USD Early Bird Apr 5- 6, , (), 25th (F). 4x, , 2nd (F). The Perkins Center welcomes Rev. Sandra Van Opstal for the Liz Mosbo VerHage and Michael Won. Get your tickets by January 24 for the early bird! Sign up for the Perkins Restaurant & Bakery eClub newsletter and receive 20% off your next order. One coupon per person per visit at participating Perkins Restaurant & Bakery Meals and Early Bird Specials. SAVE $ $ Off Any $ Purchase*. C Varied menu for all diets. Food generous for reasonable price. Service great, everypme made you feel very welcomed. Close College for Life sub menu. Enrollment & Registration · Catalog · Browse Classes · Early Bird Registration · Earn Credit through Advanced Placement. Close menu. Early bird rate ends 31 July for this non-profit community focused conference. No alternative text description for this image. 1. Early Childhood Center Calendar · HS Bell Schedule · Menus · State-Required Information · T-bird Sports Store Menu. Apptegy's Third-Party Vendor Information. Early Bird Invitational. 5th of 6 teams. Story recap Main Navigation Menu. Search: Go. Sports. Quick Links; Home Events Live. We don't depart this world with a U-haul so unload that trailer. Early bird's profile picture. Early bird. QUARANTINQUINOX's profile picture. Family dining with assorted breakfast, lunch, dinner and dessert items at reasonable prices. Breakfast available all day. bird Hotline. over 4 years ago, Guy-Perkins Schools. Menu for May Celebrating our Guy-Perkins Seniors! over 4 years ago, Guy-Perkins Schools. Nitz Photo.

How Can I Remove A Repossession From My Credit Report

#2: Negotiate with Your Lender One of the most effective ways to remove a repossession from your credit report is to negotiate directly with your lender. Removing a repossession from your credit report is possible, but your options are extremely limited. As mentioned above, repossession can be disputed only if. You can dispute a repossession by sending a letter to the credit bureau that's reporting wrong information on your credit report — Equifax, TransUnion, or. Debtors must directly contact credit reporting agencies to discuss how long a bankruptcy case remains on a credit report. File a dispute: If you go through your credit reports and see anything reported inaccurately about your repossession, you can dispute it with the credit bureaus. That Car Repossession on Your Credit Report The car repossessions happened nearly 3 years ago. That means the credit impacts could have lost some potency. But. To OP, there's no way to "remove" this, but you can recover. Keep all your other accounts in good standing, work on extending the length of your. It doesn't remove the repossession from your credit report, but it does get your car back and bring your loan payments up to date. Some states also allow. In this article, we'll explore the options available to you, including the possibility of early removal or simply having to wait it out, and finally. #2: Negotiate with Your Lender One of the most effective ways to remove a repossession from your credit report is to negotiate directly with your lender. Removing a repossession from your credit report is possible, but your options are extremely limited. As mentioned above, repossession can be disputed only if. You can dispute a repossession by sending a letter to the credit bureau that's reporting wrong information on your credit report — Equifax, TransUnion, or. Debtors must directly contact credit reporting agencies to discuss how long a bankruptcy case remains on a credit report. File a dispute: If you go through your credit reports and see anything reported inaccurately about your repossession, you can dispute it with the credit bureaus. That Car Repossession on Your Credit Report The car repossessions happened nearly 3 years ago. That means the credit impacts could have lost some potency. But. To OP, there's no way to "remove" this, but you can recover. Keep all your other accounts in good standing, work on extending the length of your. It doesn't remove the repossession from your credit report, but it does get your car back and bring your loan payments up to date. Some states also allow. In this article, we'll explore the options available to you, including the possibility of early removal or simply having to wait it out, and finally.

Next, contact the lender who repossessed your vehicle and request that they remove the repossession from your credit report. If a lender repossesses your collateral, your credit scores are likely to drop. Repossessions are typically reported to the three nationwide consumer reporting. Your report contains a consumer identification or report number that should be included with your dispute to allow the credit reporting company to identify you. And, even with a voluntary repossession, your creditor still may put the late payments or repossession on your credit report. Learn more about how. There are three ways to remove a repossession from your credit report: Filing a dispute with the credit bureaus or your creditor Negotiating. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal. Lenders can report foreclosure on your credit, and it can remain on your credit report for seven years from your first missed mortgage payment. During this time. Debtors must directly contact credit reporting agencies to discuss how long a bankruptcy case remains on a credit report. Step 1: Print three separate copies of all the paperwork related to your repossession and the redemption. You must find discrepancies between your paperwork. Remove Repossession from your Credit Report with our DIY Credit Dispute Letter Template for Repo Cars. Our Printable and Editable Word Doc or PDF is perfect for. Can Repossessions Be Removed From a Credit Report? In addition to disputing the repossession, you could also negotiate with the lender to pay off the balance. It's also important to keep in mind that repossession can be removed from your credit report in various ways or can be reported differently based on the actions. That Car Repossession on Your Credit Report The car repossessions happened nearly 3 years ago. That means the credit impacts could have lost some potency. But. But Experian says that once that time period ends, they'll automatically remove the account from your credit report. How to rebuild credit after a repossession. Make sure you pay all of your bills on time, every single month. Late payments can stay on your credit reports for up to 7 years, too. Sure, you had late. And, even with a voluntary repossession, your creditor still may put the late payments or repossession on your credit report. Learn more about how. If you're looking to improve your credit score, one of the first things you'll want to do is remove any repossessions from your credit. It doesn't remove the repossession from your credit report, but it does get your car back and bring your loan payments up to date. Some states also allow. Your report contains a consumer identification or report number that should be included with your dispute to allow the credit reporting company to identify you. Congress passed the FCRA Laws which allows you to permanently remove negative items from your credit report using pre written dispute letters. You can remove.

How Much Are Car Bills

Many payouts are much larger and some are smaller. Medical expenses from car accident injuries come from costs, such as: Ambulance trips; Emergency medical. Many Florida residents find themselves struggling to afford the typical costs of medical care. Fortunately, car accident victims have legal rights and may be. In , owning and operating an average sedan costs $8, per year, which is equal to $ per month or 57 cents per mile. If these numbers shock you, then. By Joyce Novotny-Prettiman, Esq. After an auto accident, many of our clients are surprised to learn that their own insurance company pays their medical. Average car price ; Medium sedan, $1,, $25, ; Compact SUV, $, $27, ; Medium SUV, $1,, $30, ; Midsize pickup, $1,, $29, You don't just pay for the purchase price, you also need to pay car insurance, MOT, car tax, maintenance, parking and road charges when needed. The car can also. Overall, Americans owe $ trillion in auto loan debt, according to the Federal Reserve Bank of New York, accounting for % of American consumer debt. Itemized average total costs for the average American driver to own and operate an automobile. This yearly value, around US$, corresponds, according to. Because another car of the same value would need repairs too. Think in terms of how much do you value keeping this car on the road, vs the. Many payouts are much larger and some are smaller. Medical expenses from car accident injuries come from costs, such as: Ambulance trips; Emergency medical. Many Florida residents find themselves struggling to afford the typical costs of medical care. Fortunately, car accident victims have legal rights and may be. In , owning and operating an average sedan costs $8, per year, which is equal to $ per month or 57 cents per mile. If these numbers shock you, then. By Joyce Novotny-Prettiman, Esq. After an auto accident, many of our clients are surprised to learn that their own insurance company pays their medical. Average car price ; Medium sedan, $1,, $25, ; Compact SUV, $, $27, ; Medium SUV, $1,, $30, ; Midsize pickup, $1,, $29, You don't just pay for the purchase price, you also need to pay car insurance, MOT, car tax, maintenance, parking and road charges when needed. The car can also. Overall, Americans owe $ trillion in auto loan debt, according to the Federal Reserve Bank of New York, accounting for % of American consumer debt. Itemized average total costs for the average American driver to own and operate an automobile. This yearly value, around US$, corresponds, according to. Because another car of the same value would need repairs too. Think in terms of how much do you value keeping this car on the road, vs the.

car will cost you much less per month than a $40, gasoline car. It's going to be very tough to make car payments, rent and bills on. Evaluate whether you can afford a vehicle by estimating your monthly payment and comparing it to your budget with comprastrend.online's car affordability calculator. Find out in which scenarios a customer may use a bill of sale to transfer vehicle ownership. Compare electric cars vs petrol & diesel costs per mile, and how much it costs to charge at home and public charge points. Registration can range from less than $50 to more than $, depending on where you live. Sales tax. The sales tax, which will vary by state, is the most. Spend no more than 10% of your salary on transportation expenses, including car payment, insurance, and fuel. Who pays them, and how are they covered? Let's take a closer look. Does Auto Insurance Cover Medical Expenses & Bills? Medical Bills & No-Fault Insurance in New York. New York is a no-fault state when it comes to auto insurance. This means that your own insurance company should. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. How To Calculate a Fair Profit New Car Offer Once you find a vehicle that fits your budget and your lifestyle, calculate a profit margin that's both within. There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home. For what we've been paying in repairs we could have been driving newer cars. We could have even leased and not been much behind in expense. Do I. For what we've been paying in repairs we could have been driving newer cars. We could have even leased and not been much behind in expense. Do I. Consumer Alternatives. Many consumers contact their local Better Business Bureau (BBB) to register complaints regarding area businesses. Refer to the Business. Calculate the maximum car amount you can afford based on your preferred monthly payment with Autotrader's Car Affordability Calculator. How To Calculate a Fair Profit New Car Offer Once you find a vehicle that fits your budget and your lifestyle, calculate a profit margin that's both within. How much of a down payment should I make? The rule of thumb is to put down 20 percent of the value of the car. This amount is large enough to keep you from. Car insurance premiums are based in part on the car's price, the cost to repair it, its overall safety record and the likelihood of theft. Many insurers offer. The damage from a car accident often results in significant repair bills. Even relatively minor body damage may total an older vehicle with a low value. The. There are limits on how much depreciation you can deduct. For Expenses to figure the deductions for your car expenses. Page Last Reviewed.

Sewer Backup Covered By Insurance

A sewer line endorsement (also known as buried utility lines coverage) may cover damage not only to your underground pipes, but to other underground wires. Sewer Backup Insurance Coverage A sewer backup loss is excluded under most homeowners' policies, but most insurer's, will provide an option of purchasing back. Homeowners Insurance does not cover sewer backup. A special sewer backup coverage must be purchased to be covered. Preventive Measures. To help avoid this. This coverage protects your home when water overflows a sump pump or sewage enters your home through pipes designed to carry it away. Most homeowners insurance policies come with an endorsement for water backup and sump discharge which will cover losses, up to a certain limit, caused by the. Water backup and sump overflow coverage is an endorsement that can be added to your homeowners insurance to help pay for damage caused by backed up sewers. Water Backup coverage is an optional coverage that helps cover the cost of water damage caused by drain and sewer backups and sump pump failures. You can protect yourself by adding water backup coverage—also known as sewer backup coverage—to your homeowners insurance policy. Sump pumps. Many homes have. The coverage should actually be called "drain backup." It covers losses resulting from any drain on your property including roof, sewer, sink. A sewer line endorsement (also known as buried utility lines coverage) may cover damage not only to your underground pipes, but to other underground wires. Sewer Backup Insurance Coverage A sewer backup loss is excluded under most homeowners' policies, but most insurer's, will provide an option of purchasing back. Homeowners Insurance does not cover sewer backup. A special sewer backup coverage must be purchased to be covered. Preventive Measures. To help avoid this. This coverage protects your home when water overflows a sump pump or sewage enters your home through pipes designed to carry it away. Most homeowners insurance policies come with an endorsement for water backup and sump discharge which will cover losses, up to a certain limit, caused by the. Water backup and sump overflow coverage is an endorsement that can be added to your homeowners insurance to help pay for damage caused by backed up sewers. Water Backup coverage is an optional coverage that helps cover the cost of water damage caused by drain and sewer backups and sump pump failures. You can protect yourself by adding water backup coverage—also known as sewer backup coverage—to your homeowners insurance policy. Sump pumps. Many homes have. The coverage should actually be called "drain backup." It covers losses resulting from any drain on your property including roof, sewer, sink.

Water backup insurance can be there for you if your sump pump fails. Here are four reasons to consider adding sewer backup to your policy. Homeowners insurance generally covers accidental water damage from a sudden event like a burst pipe, but it doesn't cover water damage caused by sewer line. Nearly all property forms, including Homeowners policies, exclude or restrict water damage caused by the backup of sewers or drains. · NOTE: Coverage for sewer. This coverage, often called Sewer Backup, can be purchased at a reasonable premium to provide protection for your dwelling and contents in the event of a loss. While homeowners insurance protects you against some forms of unexpected water damage, water back-ups and sump pump overflows are usually not covered. Adding water backup coverage, which is also often called a sump pump or sewer backup endorsement, can increase the cost of your homeowners insurance premiums by. While these safety measures can help minimize the risk of a sewer backup occurring at your home, it's important to remember that sewer backups aren't typically. Sewer and water backup coverage can help cover the costs associated with cleaning up and repairing damage to your home and personal belongings caused by water. Though flood coverage is common, many home insurance policies exclude damage related to water backups. · Water backups can result from clogged sewer lines and. However, it does not include damages caused by water backing up through sewers, drains, appliances, or sump pumps. Adding a water backup endorsement to your. Most homeowners insurance policies don't automatically include coverage for sewer and drain backups. If you have a sewer backup in your home, think of. Water backup insurance provides coverage for damage to your property caused by a clogged sewer line, failed sump pump and backed up drains. Sewer backup insurance provides financial protection to your home against damages related to water that backs up (sewer backups) through your plumbing system. Does homeowners' insurance cover sewer backup? Most homeowners policies do not cover damage from sewer backups. Water backup coverage may need to be added to a. But, unfortunately, water backup due to sewage, sump pump or other related issues don't experience the same coverage under standard homeowners insurance. What is "Sewer Backup"? Most homeowner and business insurance policies do not cover sewer backup unless specific sewer backup coverage is added to the. Backed-up sewer lines can overflow into your home, causing damage to your basement that could require expensive repairs. Adding water backup coverage. Worst of all, without the proper insurance coverage, you could be left paying out-of-pocket for the cleanup and for any damage the water backup caused to. It covers water that backs up through sewers or drains or overflows through a sump pump. In other words, water backup insurance protects your home and personal. The sewer and drain water backup endorsement covers water damage to the dwelling and personal property from a sewer, drain or sup pump backup or overflow.

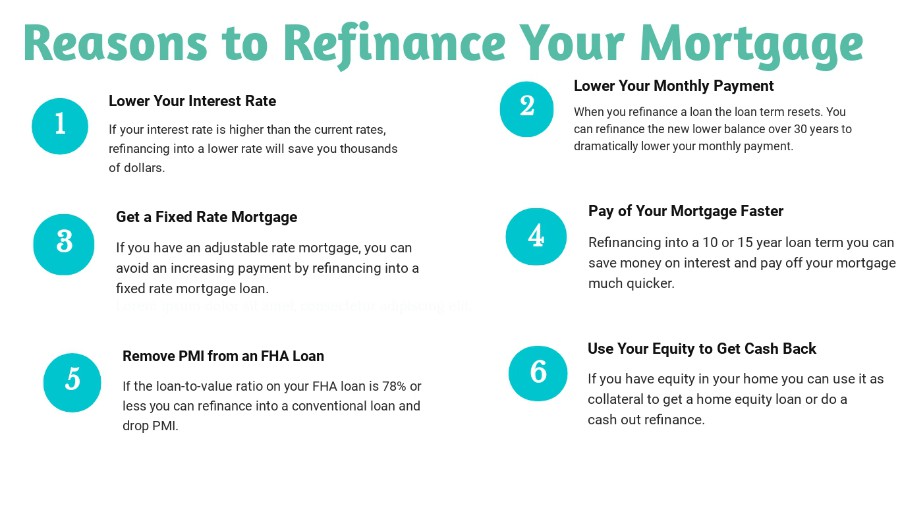

Do I Get Money If I Refinance My House

Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%. No. The cash you collect from a cash-out refinance isn't taxed. The money you receive is essentially a loan you are taking out against your home's equity, and. The amount of money you can borrow by refinancing is up to 80% of the equity you have in your home, subject to any additional charges. Frequently Asked. How refinancing a mortgage works. When you refinance your mortgage, you take out a new mortgage and use the money to pay off your original loan. Ideally. Some mortgages allow a “cash-out” refinance, so you can turn some of your home equity into cash or use it to pay off high-cost debt. The money you take out will. You can lower your interest rate. If mortgage rates have dropped since you purchased your home or if your credit score has improved, a refinance can help you. Refinancing could save you money on your monthly mortgage payment and over the long term if you get a lower interest rate. Here's how to know when the time. A cash-out refinance works best when you are also able to score a lower interest rate on your new mortgage, compared with your current one. So, when does it. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Explore cash-out refinance loans. Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%. No. The cash you collect from a cash-out refinance isn't taxed. The money you receive is essentially a loan you are taking out against your home's equity, and. The amount of money you can borrow by refinancing is up to 80% of the equity you have in your home, subject to any additional charges. Frequently Asked. How refinancing a mortgage works. When you refinance your mortgage, you take out a new mortgage and use the money to pay off your original loan. Ideally. Some mortgages allow a “cash-out” refinance, so you can turn some of your home equity into cash or use it to pay off high-cost debt. The money you take out will. You can lower your interest rate. If mortgage rates have dropped since you purchased your home or if your credit score has improved, a refinance can help you. Refinancing could save you money on your monthly mortgage payment and over the long term if you get a lower interest rate. Here's how to know when the time. A cash-out refinance works best when you are also able to score a lower interest rate on your new mortgage, compared with your current one. So, when does it. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Explore cash-out refinance loans.

With a no cash-out refinance, you are primarily refinancing the remaining unpaid balance on your mortgage. This is the most common option and may make sense if. Lower monthly payments can come with lower interest rates, but you can also lower your payments and have extra cash each month for other expenses by lengthening. Funding major home renovations with a cash-out refinance When you do a cash-out refinance, you get a new, larger mortgage that pays off your original mortgage. The equity in your home: For cash-out refinancing, most lenders will usually allow you to borrow up to 80% of the value of your home. As such, the cash amount. The difference between the new loan amount and your existing mortgage balance is then disbursed to you in cash. The extra cash is yours to use for things like. Terms to Know · Your refinanced mortgage replaces your old mortgage. Your current loan balance and the amount of cash you take out will make up your new loan. The more money you put into your home, the easier it will be to refinance, regardless of when you do it. Ideally, you should pay at least 20% of the home's. Generally, if you can get a rate that is at least one to two percent less than your existing rate, you can consider refinancing your mortgage. No rule of thumb. Refinancing happens when you pay off your current mortgage with money from a new mortgage. Often homeowners refinance to try to lower the cost of their mortgage. Getting money out of refinance is not income. It is a shift of assets - lowering the equity in the house by increasing the loan size and moving. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity. It may make sense to consider refinancing if your financial circumstances have improved since you took out your original mortgage. Refinancing isn't beneficial. A cash out refinance allows you to refinance your home for more than what you owe and receive the difference in a lump sum of cash. For example, say you bought. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. You pay back the new loan over time, usually between 15 and 30 years. Your home acts as collateral on the loan, just like with a regular mortgage. How does a. Learn the benefits of refinancing your mortgage. When refinancing your loan you may get a lower interest rate, shorter term, and pay off your home loan. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. While you may not be changing your interest rate in this process, your monthly mortgage payment will be impacted by that increased principal amount. Lock your. When enough equity has accumulated, the borrower may cash out by refinancing the loan (mostly home mortgage loans) to a higher balance. However, refinancing.